Salary vs Dividend

and Why This Is Not a Simple Decision in 2026/27

For many years taking a low salary and higher dividends was viewed as the most tax efficient route for limited company owners. The approach was driven by lower dividend tax rates and the fact that dividends are not subject to National Insurance. Combine this with the tax free dividend allowance previously set at much more generous levels and the strategy became the standard for owner managed businesses across the UK.

Things have changed significantly over time. The dividend allowance has reduced year after year, tax rates have steadily increased and recent announcements in the Autumn Budget mean the gap between salary and dividend planning is narrowing even further.

What changes from April 2026

From the 2026/27 tax year business owners will face the following:

Dividend allowance remains at only £500

Dividend tax rates rise to:

Basic rate 10.75%

Higher rate 35.75%

Additional rate 39.35% (unchanged)

What this means in practice

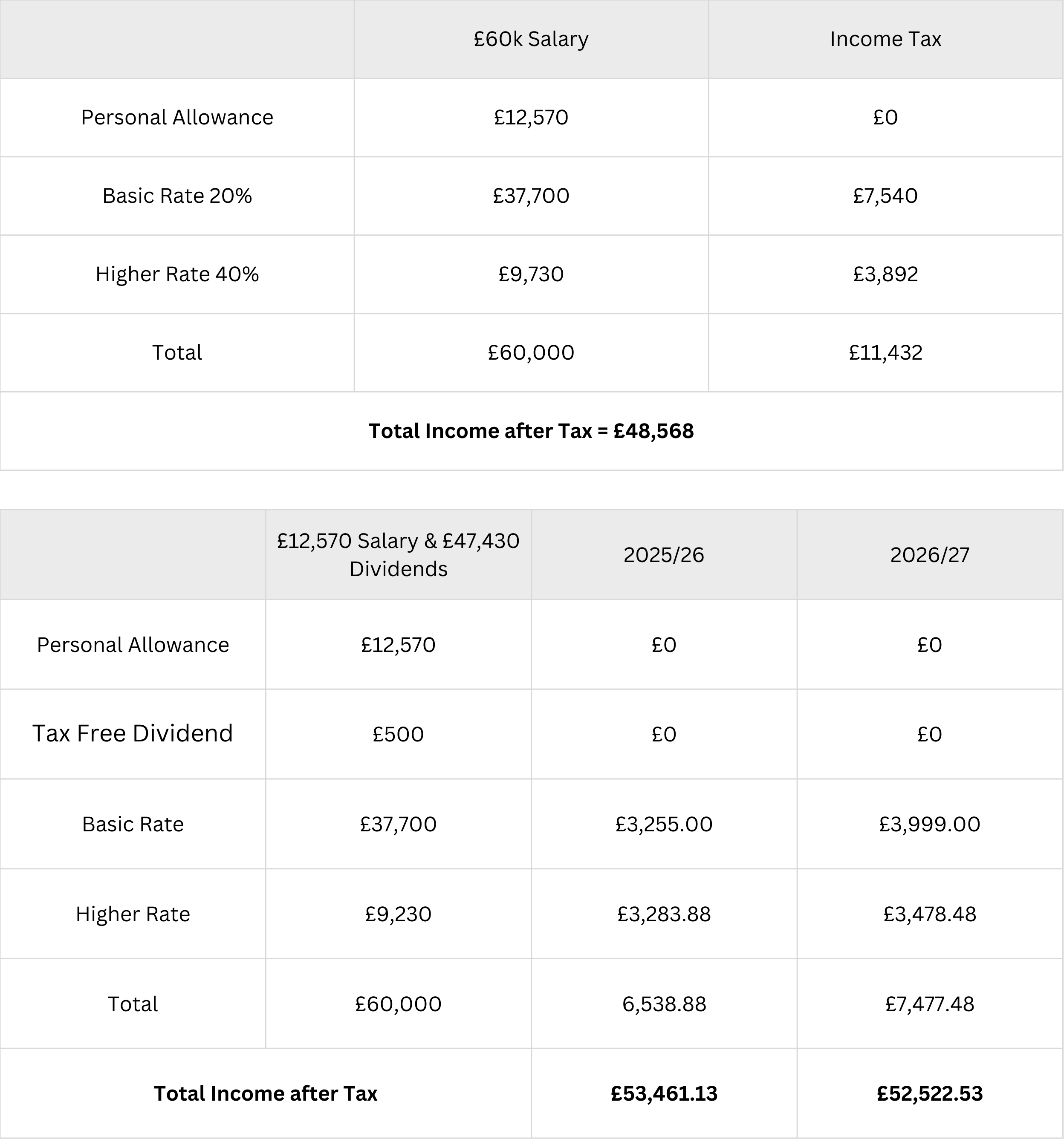

To illustrate the impact consider an individual with profit available to draw of around £60,000. Historically they may have opted for a small salary with the balance as dividends. For 2025/26 this still produces a higher net income than taking the full amount through PAYE.

In some cases PAYE may be more tax efficient because salary is tax deductible for Corporation Tax, which can change the overall outcome once company tax relief is taken into account.

Below is an example based on a £60,000 income comparison. This includes:

Full PAYE route

Salary and dividend split using 2025/26 rates

Salary and dividend split using 2026/27 rates

While dividends often still produce a higher net figure there is now a much smaller advantage and many more moving parts to consider.

Other factors that influence the best approach

Higher Income Child Benefit Charge

Where income moves above £60,000 the Higher Income Child Benefit Charge becomes a real factor in planning. The charge removes 1 percent of Child Benefit for every £200 of adjusted net income between £60,000 and £80,000. This can quickly erode the financial benefit of a dividend heavy strategy if drawings push income above the threshold.

This is particularly important when modelling remuneration options because adjusted net income includes dividends.

Dividends do not reduce Corporation Tax

Another essential point is that dividends are paid from post tax profits. Unlike salaries they do not reduce the corporation tax bill. With the main rate now linked to profit levels this can subtly shift the balance when reviewing remuneration structures.

Personal circumstances matter

Two individuals with the same profit may arrive at very different outcomes depending on:

Their other income

Child Benefit position

Student loan repayments

Pension contributions

Cash flow needs

Future plans for the business

A one size fits all salary vs dividend answer does not exist.

So is there a right answer?

There is no universal right answer in 2026/27. The Autumn Budget tax increases have made the decision more complex and the old assumptions about dividends being the clear winner do not always hold true. The most effective approach now requires thoughtful planning that takes into account personal tax thresholds, company profit levels and the wider impact on family finances.

Final note

This article provides a summary of key considerations only and should not be taken as advice. Every business owners situation is unique. If you would like tailored support with remuneration planning for 2026/27 our team at PJE Accountants and Advisors is here to help. Contact us for a personalised review of your options.

Posted - 11 December 2025