Autumn Budget 2025

Key Areas Impacting Small Business

The Autumn Budget 2025 introduces a wide range of measures set to affect businesses, employers, landlords and individual taxpayers over the next few years. As a third generation family practice supporting clients across Wales and the UK, we have highlighted the key areas that matter most, along with the timelines you need to be aware of.

National Living Wage and Minimum Wage Increases

From 1 April 2026, employers must apply the new minimum hourly rates shown below. Accurate payroll processing is essential, particularly for employees near these thresholds. If you need support with payroll, monitoring hours or ensuring compliance, our team is here to help.

Both employer and employee National Insurance Contributions will apply on Salary Sacrifice pension contributions above £2,000 per year from April 2029.

Capital Allowances and Business Investment

From January 2026, investment in equipment will benefit from increased first year capital allowances for most main rate assets where no other allowances apply. This is partly offset by a reduction in the main writing down allowance rate, decreasing from 18% to 14%.

Dividend Tax Increases for Company Shareholders

From April 2026, the tax rates on dividends will rise:

Basic rate dividend tax increases to 10.75%

Higher rate dividend tax increases to 35.75%

If you draw dividends from your company, reviewing your profit extraction strategy will be important to maximise tax efficiency going forward.

Changes for Landlords

From April 2027, property income tax rates will rise by 2% across all bands for personally owned rental properties.

Rates of capital gains tax on rental property disposals remain unchanged.

ISA Changes

The overall ISA limit stays at £20,000 per year, but from April 2027, individuals under age 65 will be limited to £12,000 in cash ISA contributions, with the remaining £8,000 only available for stocks and shares ISAs.

Taxes on Income for Individuals

Personal Allowance

The personal allowance remains at £12,570 for 2026/27. It is tapered once income exceeds £100,000 and fully withdrawn at £125,140.

Income Tax Rates and Allowances

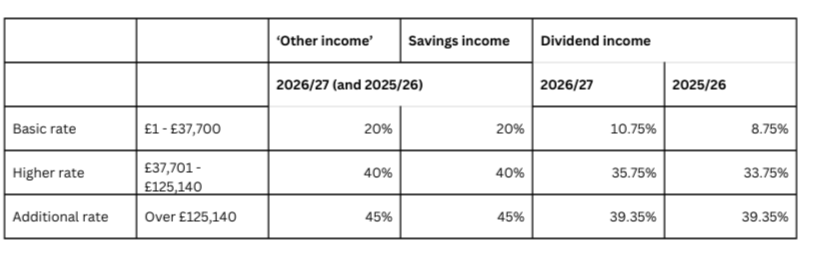

Rates and thresholds remain frozen until 2030/31, except for dividend tax increases from April 2026.

From April 2027, the government will introduce separate tax rates for property income and increase savings income tax rates:

Savings and dividend allowances remain unchanged.

Child Benefit and the High Income Child Benefit Charge

For 2026/27, the HICBC applies when income exceeds £60,000. The charge increases by 1 percent for every £200 above this level and fully removes child benefit once income exceeds £80,000.

Measures Affecting Business Owners

EMI Scheme Expansion

From 6 April 2026, the following limits will increase:

Company grant options: £3 million to £6 million

Gross assets: £30 million to £120 million

Maximum employees: 250 to 500

Maximum holding period: 10 to 15 years

These can apply retrospectively to existing EMI contracts not exercised or expired. The EMI notification requirement will be removed from April 2027.

Employee Ownership Trusts

CGT relief on disposals to Employee Ownership Trusts has been reduced from 100% to 50%. Half of the gain becomes immediately chargeable and does not qualify for BADR or investors’ relief.

IHT Reform for Business Owners and Farmers

From 6 April 2026:

The current 100 percent relief will be capped at £1 million of combined APR and BPR.

Relief above this will reduce to 50%.

Unused relief will become transferable to a spouse or civil partner.

EIS and VCT Changes

From 6 April 2026, eligibility limits increase significantly:

Gross assets test: £15 million to £30 million pre issue, £16 million to £35 million post issue.

Annual investment limit: £5 million to £10 million, or £10 million to £20 million for KICs.

Lifetime investment limit: £12 million to £24 million, or £20 million to £40 million for KICs.

The income tax relief for VCT investors will reduce from 30% to 20%. EIS relief remains unchanged.

HMRC Penalties

Corporation tax late filing penalties double from 1 April 2026:

£200 for a late return

£400 if more than 3 months late

Repeated late filing for three returns increases penalties to £1,000, or £2,000 if more than 3 months late

How PJE Can Support You

This blog provides a brief summary of selected measures from the Autumn Budget 2025 that may affect businesses and individuals. It should not be taken as advice. Every business and personal tax position is different and requires tailored consideration and planning.

The Autumn Budget introduces a series of phased changes stretching from 2026 to 2029. Understanding how each measure impacts your finances, operations and future plans is essential for making confident decisions. Our team at PJE Accountants and Advisors can work with you to develop tax efficient strategies, ensure payroll and compliance obligations are met, and support long term business and personal financial planning.

If you would like advice tailored to your situation, please get in touch with our offices in Aberystwyth, Lampeter, Aberaeron or Dolgellau, or book a digital consultation with our team.

Posted - 11 December 2025